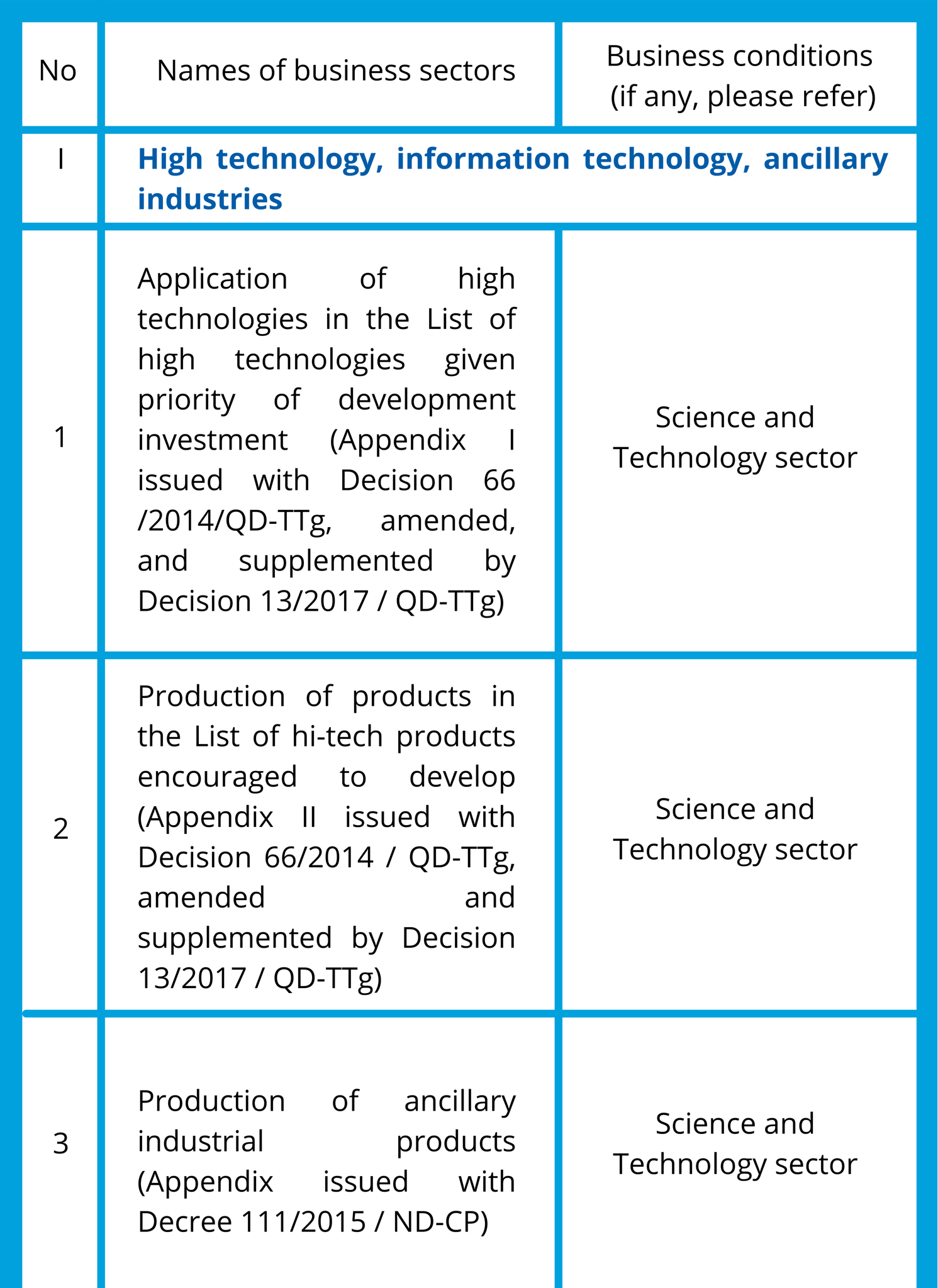

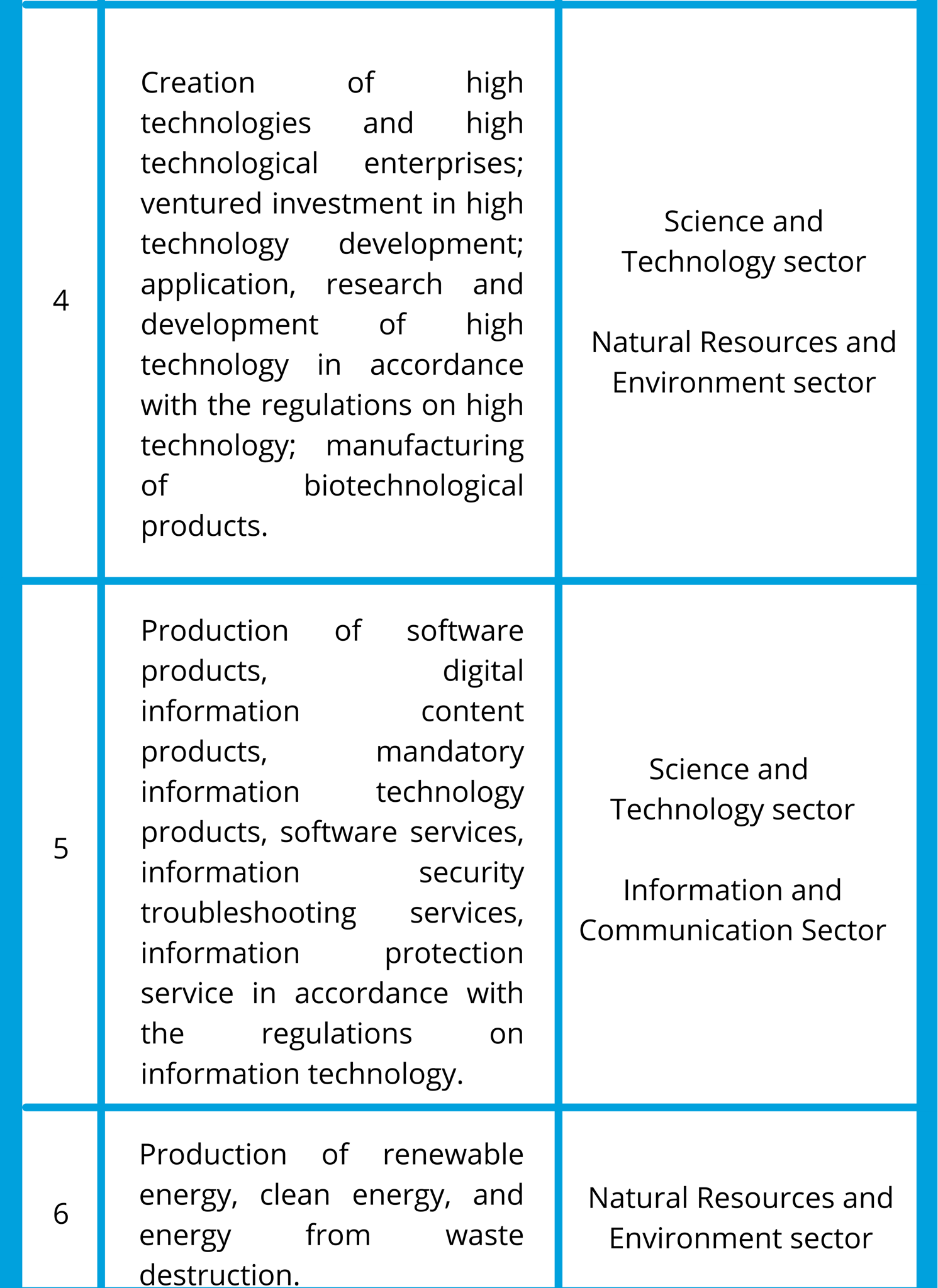

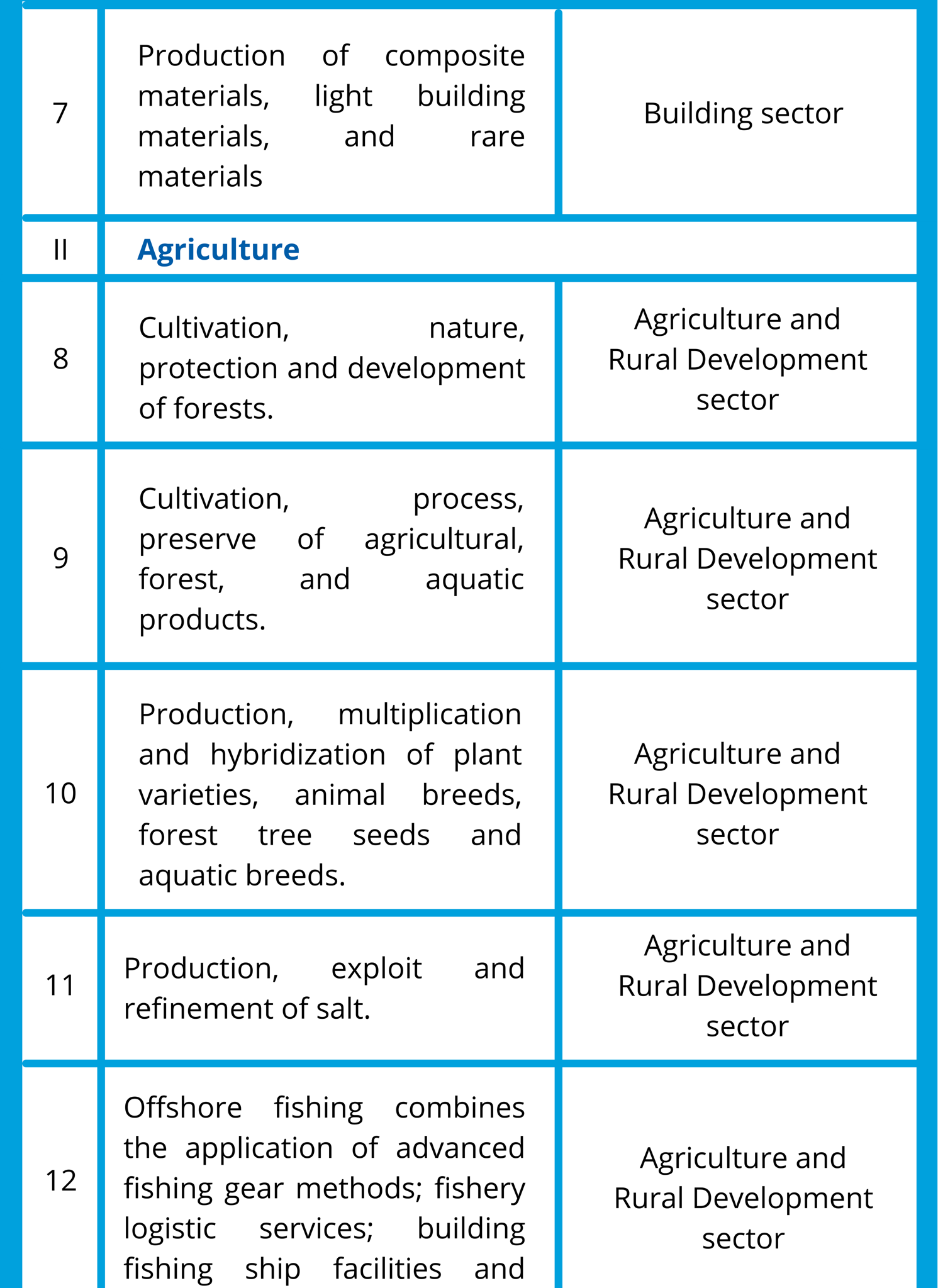

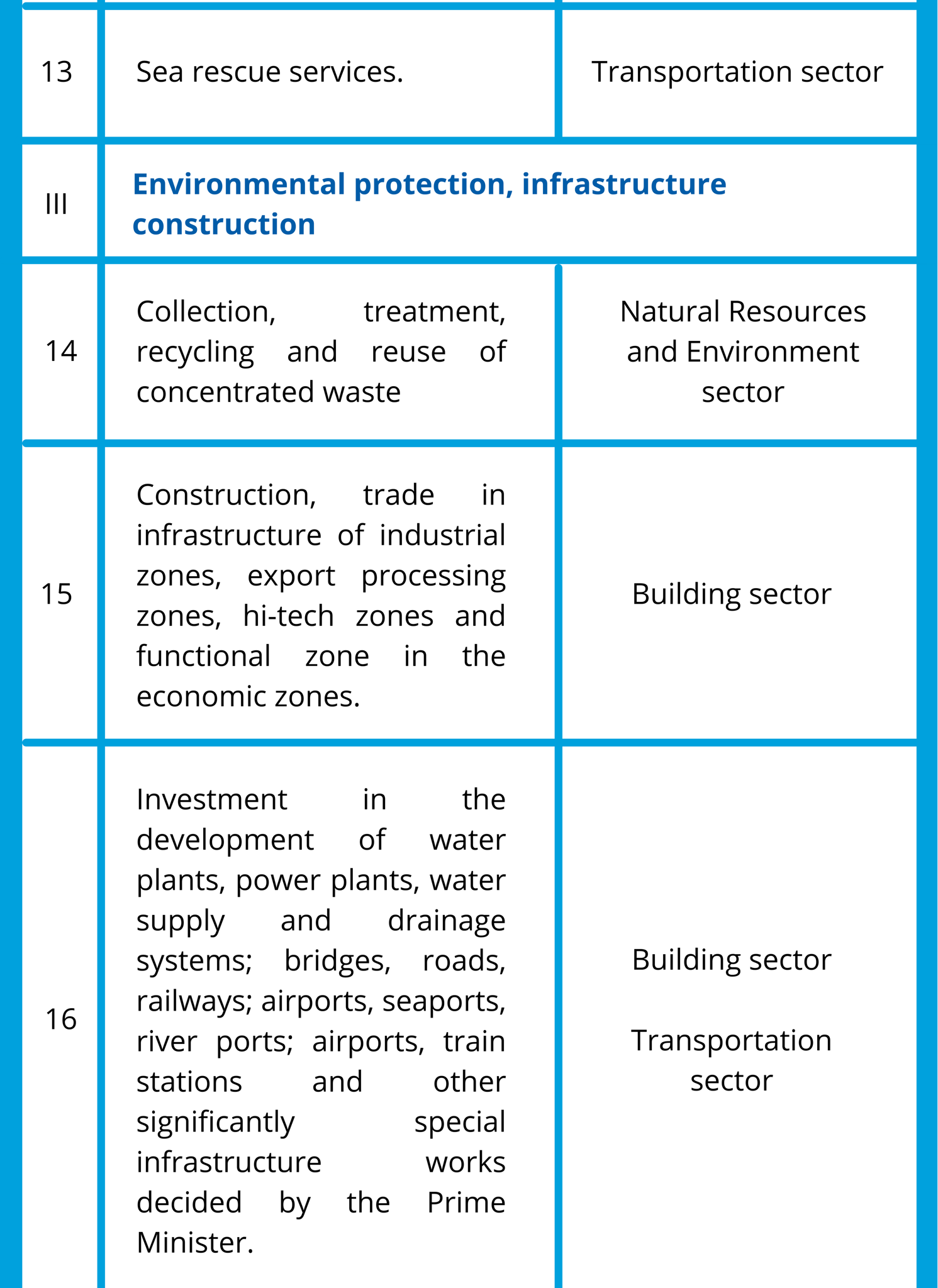

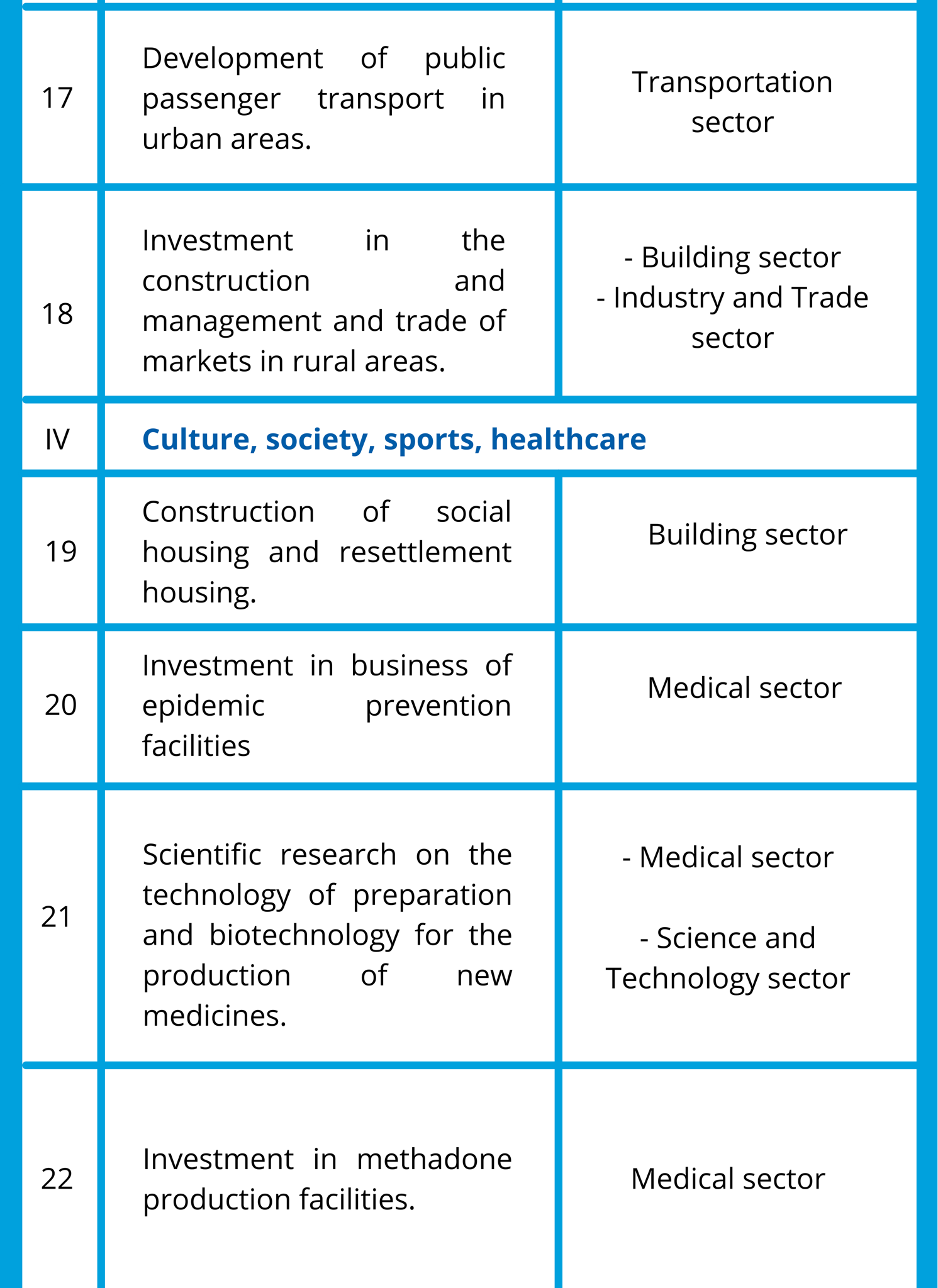

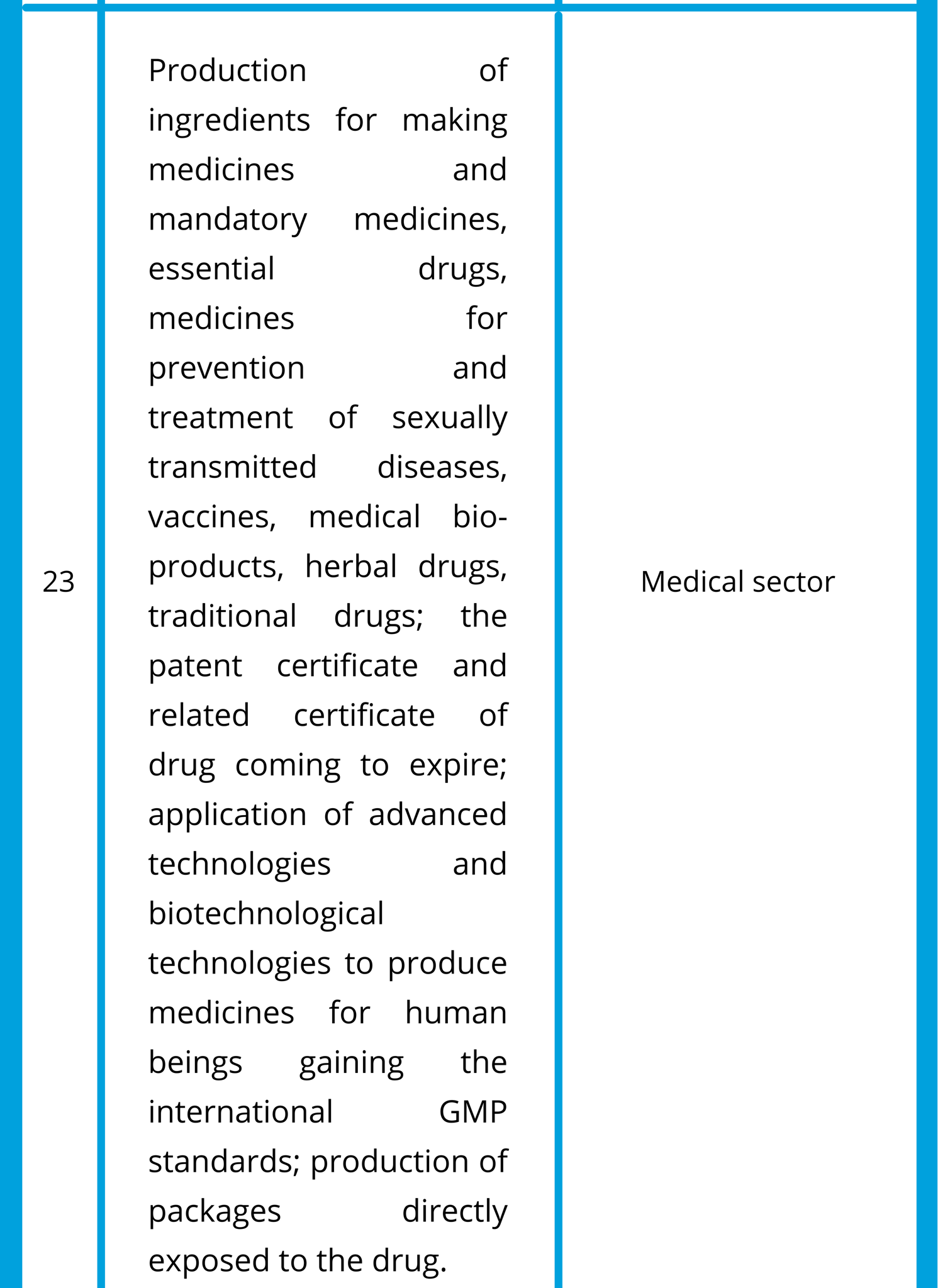

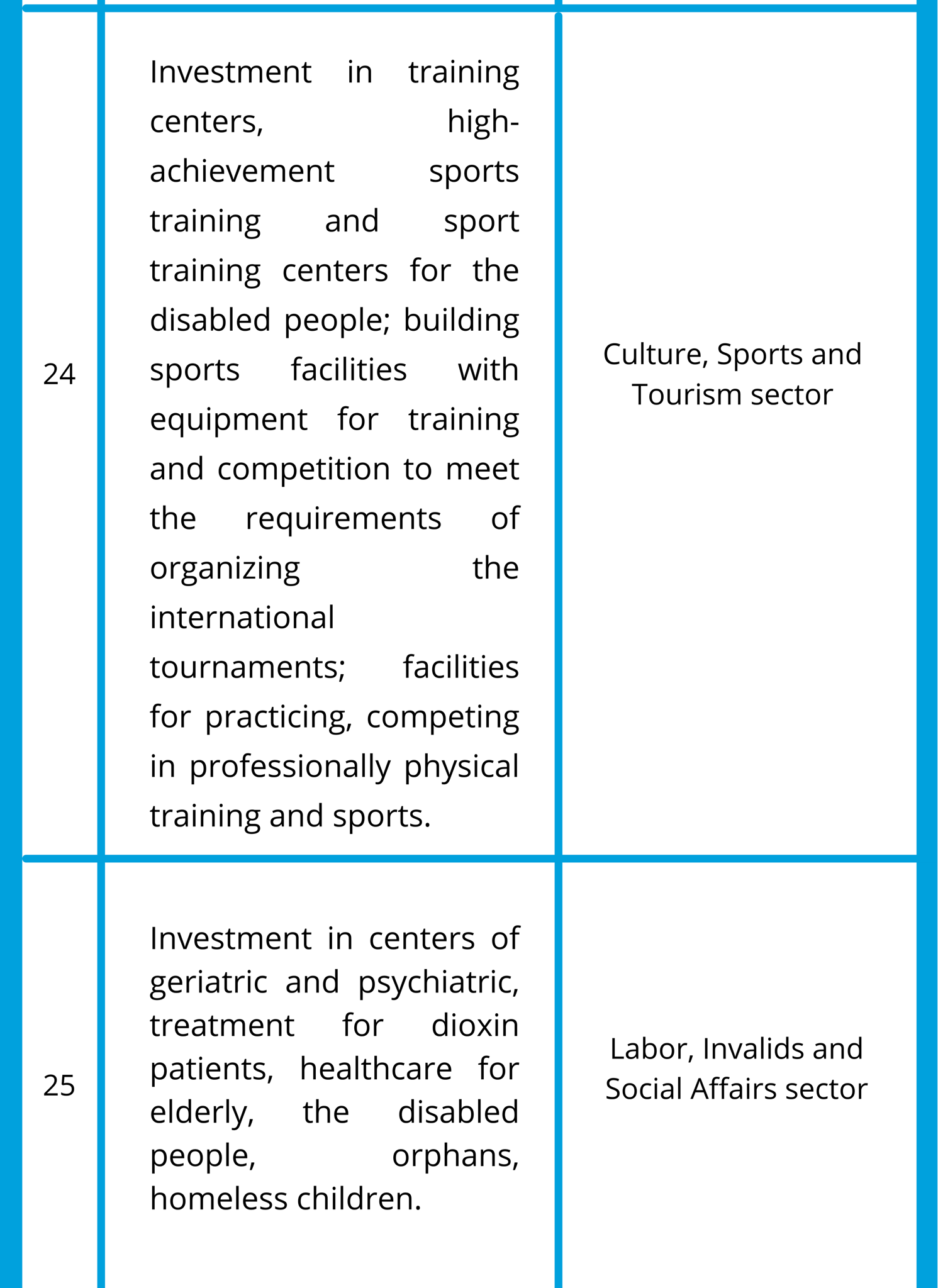

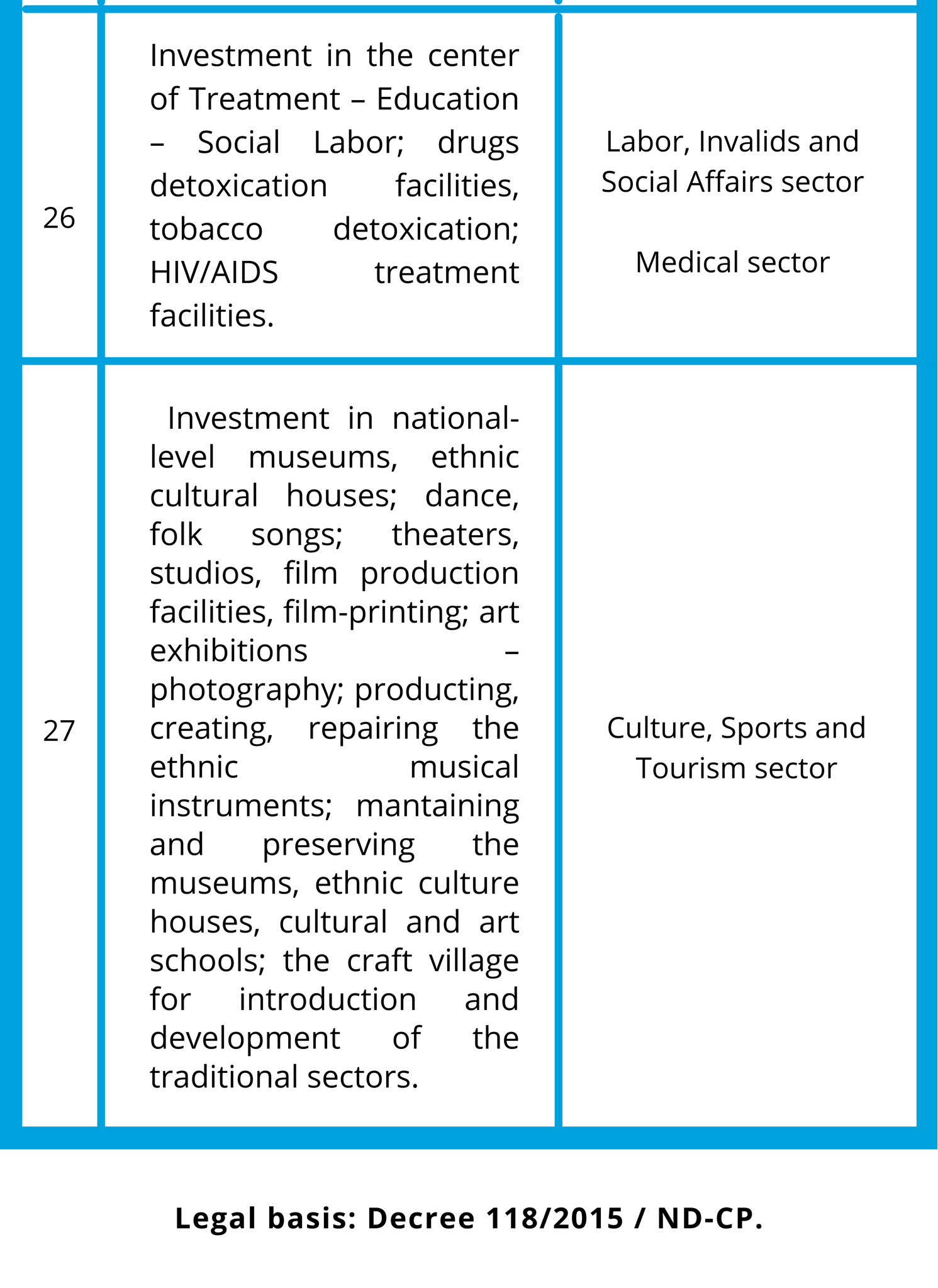

Before conducting investment in the form of establishing new economic organizations in Vietnam, foreign investors always need to refer to business sectors with investment incentives policies that the State of Vietnam has issued in order to entitle special incentives to support effective business investment activities.

When registering special industries with investment incentives, investors will be entitled to:

- Apply corporate income tax (CIT) lower than normal tax rates for a certain period of time or the entire investment project implementation period. Or exemption or reduction of corporate income tax.

- Import tax exemption for imported goods to create stable assets, raw materials, supplies, and components to implement investment projects.

- Exemption or reduction of land rent, land use levy, land use tax.